Tate Modern’s Frida: The Making of an Icon (25 June 2026 – 3 January 2027) explores how Frida Kahlo evolved from painter to global cultural icon. Developed with the Museum of Fine Arts, Houston, the exhibition traces her lasting influence across art, feminism and popular culture, positioning Kahlo as a figure continually reinterpreted by new generations.

Findings from the UBS report. The New Art Class: How Women, Gen Z, and Digital Platforms Are Redefining Collecting in 2025

The latest Art Basel & UBS Survey of Global Collecting reveals a new balance of power in the art world — where women lead in spending, Gen Z embraces digital art, and collecting becomes as much about identity as investment.

The contours of global collecting are shifting — and quickly.

According to The Art Basel & UBS Survey of Global Collecting 2025, authored by Dr. Clare McAndrew of Arts Economics, art ownership today looks very different from even a few years ago. The archetype of the discreet, male connoisseur has been replaced by a more diverse and globally connected collector base: younger, increasingly female, and fluent in both finance and digital culture. This transformation goes far beyond taste. It reflects a deeper rethinking of how wealth, identity, and value intersect in today’s global art economy.

Despite a challenging macroeconomic backdrop, collectors are deepening their engagement with art. In 2025, high-net-worth individuals (HNWIs) allocated an average of 20% of their total wealth to art, up from 15% in 2024. Among ultra-high-net-worth collectors — those with over $50 million in assets — allocations rose to 28%. The survey highlights a strong generational momentum: Gen Z collectors allocated 26% of their portfolios to art, the highest share across all age groups. Moreover, 84% of respondents have inherited artworks, and almost all of them retained those pieces. This continuity between inheritance and innovation marks a key shift — the next generation is not only inheriting art but evolving its meaning.

One of the most striking findings of the 2025 report is the expanding role of women in shaping the global art market.

Women made up 50% of respondents, and their average annual spending on art was 46% higher than men’s. In China, female collectors spent more than double their male counterparts. Women are also driving progress in representation: works by female artists now account for 44% of total HNWI collections, up from 33% in 2018, and nearly reaching parity among women collectors themselves (49%). The report notes that female collectors are also more inclined toward discovery. Fifty-five percent of women said they often buy works by artists new to them, compared to 44% of men — suggesting a strong appetite for experimentation alongside social and cultural engagement.

“Women collectors are now central to the global art ecosystem — not only through their spending power but through the values they prioritize.”

— Art Basel & UBS Survey of Global Collecting 2025

Millennials and Gen Z now make up three-quarters of all HNW collectors, a demographic shift that is reshaping the market’s tone and focus. While boomers still report the highest average annual spend (around $993,000), younger buyers are fast expanding their influence — and diversifying their portfolios.Traditional mediums such as painting remain dominant, but digital art has become the fastest-growing collecting category. Over half of HNWIs (51%) purchased a digital artwork in 2024–2025, making it the third most valuable category, alongside sculpture. This isn’t the speculative NFT wave of 2021; it’s a more measured embrace of technology as a legitimate collecting medium. For younger buyers, digital art sits comfortably beside physical works — a reflection of how seamlessly they navigate both worlds.

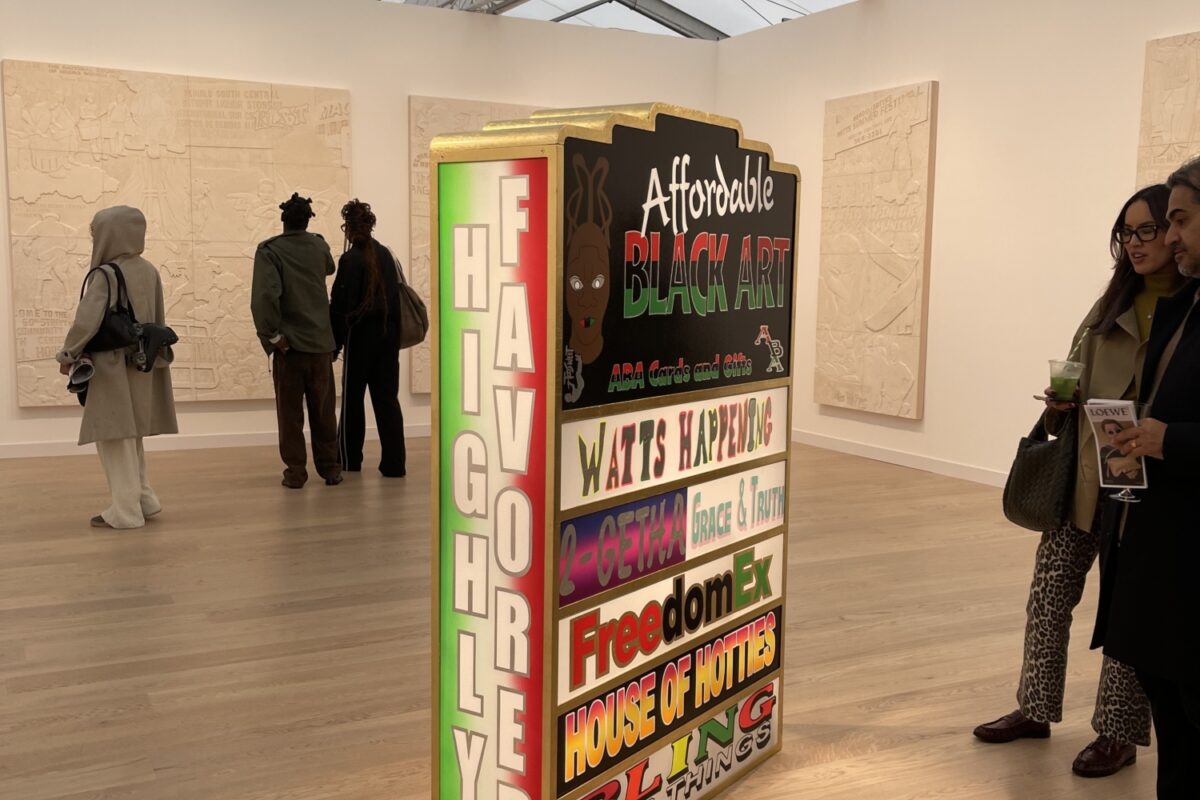

Collectors continue to rely on galleries and dealers as their main partners — 83% of HNWIs made at least one purchase through them in 2025 — but their buying behavior has diversified.More than half of respondents (51%) purchased at least one artwork directly via Instagram or other social platforms, often without viewing it in person. This rise in online confidence is transforming how art circulates and how relationships between artists, dealers, and collectors form.Dealers remain the dominant sales channel, accounting for 43% of global HNWI art spending. Yet direct-to-artist sales have doubled year-on-year, reaching 20% of total spending. Collectors are also commissioning works directly (37%) and visiting studios (43%), underscoring a desire for transparency and connection. Art fairs continue to play a key role in discovery and networking: 58% of HNWIs purchased works connected to art fairs in 2025, a clear rebound from 39% in 2023. Auctions, however, saw a notable decline. Only 49% of collectors bought at auction, down from 74% two years ago, with total spending through auction houses falling to 12% of the market.

Collecting today is about more than art — it’s about cultural lifestyle. The survey found that 59% of total collector spending went to fine and decorative art, while 41% went toward collectibles such as jewelry, design objects, watches, and cars. Gen Z collectors lead the charge in this area, dedicating 56% of their total spend to collectibles. The boundaries between asset classes have blurred: fine art, design, and fashion increasingly coexist in cohesive, self-expressive collections. In this hybrid landscape, collecting functions not only as an investment strategy but as a form of identity curation — a way of articulating personal values through ownership.

The report underscores a growing emphasis on legacy among global collectors. Nearly 80% plan to pass their collections to family, while 70% intend to donate artworks to museums or charitable foundations. This rise in philanthropic intent aligns with a broader wealth transition. As the world enters what UBS calls “The Great Wealth Transfer,” women are expected to control an increasing share of global assets — and their collecting and donation patterns are already reshaping institutional priorities. The result is a market that feels more engaged with cultural and ethical considerations, emphasizing stewardship over speculation.

Despite macroeconomic challenges, sentiment remains strikingly positive.Eighty-four percent of HNW collectors are optimistic about the art market’s performance through 2025, and 81% expect further growth within a year. Global art sales fell 12% in 2024 to $57.5 billion, largely due to slower cross-border trade (imports and exports both down 14%). Yet collectors remain confident: 40% plan to buy more art in the coming year, while only 25% plan to sell. Their primary concerns are regulatory — trade barriers, transparency, and digital security — rather than artistic or financial. In other words, confidence in art’s cultural and economic value remains high.

The 2025 survey captures a market in transition: more measured, more inclusive, and more self-aware.Art collecting is no longer confined to a narrow elite. It has become a field where women lead in spending, Gen Z experiments with digital mediums, and collectors increasingly seek meaning over speculation.If art has always reflected its era, 2025’s collecting culture paints a clear picture — one of diversity, confidence, and redefined influence. The art world, it seems, has found its next generation of stewards.

Sources: The Art Basel & UBS Survey of Global Collecting 2025, Arts Economics; UBS Global Wealth Report 2025.

OBTUSE (°): , the inaugural exhibition of Obtuse Archive at Galleria Objets, brings together thirteen artists and three performers across sculpture, installation, sound, and performance. Decentering painting and privileging material experimentation, the show explores spatial tension, encounter, and the productive unresolved, positioning Obtuse Archive as a cultural platform in motion.

The Turner Prize 2025 has been awarded to Nnena Kalu. The winner of the £25,000 prize was announced this evening at a ceremony at Bradford Grammar School presented by magician Steven Frayne, formerly known as Dynamo, in Bradford, this year’s UK City of Culture, and broadcast live on BBC News.